Plan. Execute. Profit. The Prorex Investment Blueprint for Consistent Forex Results

In the forex arena, traders win not by luck but by crafting precise strategies and executing them flawlessly. Your broker is not a passive partner but a critical component of your operational toolkit. Every feature, every fee, and every function must be analyzed for its strategic value. This briefing will deconstruct the Prorex investment framework, not as a simple list of features, but as a set of tactical tools. Traders aim to leverage this platform to execute their trading game plans with precision and efficiency in 2025.

Content

Tactical Execution within the Prorex Investment Command Center

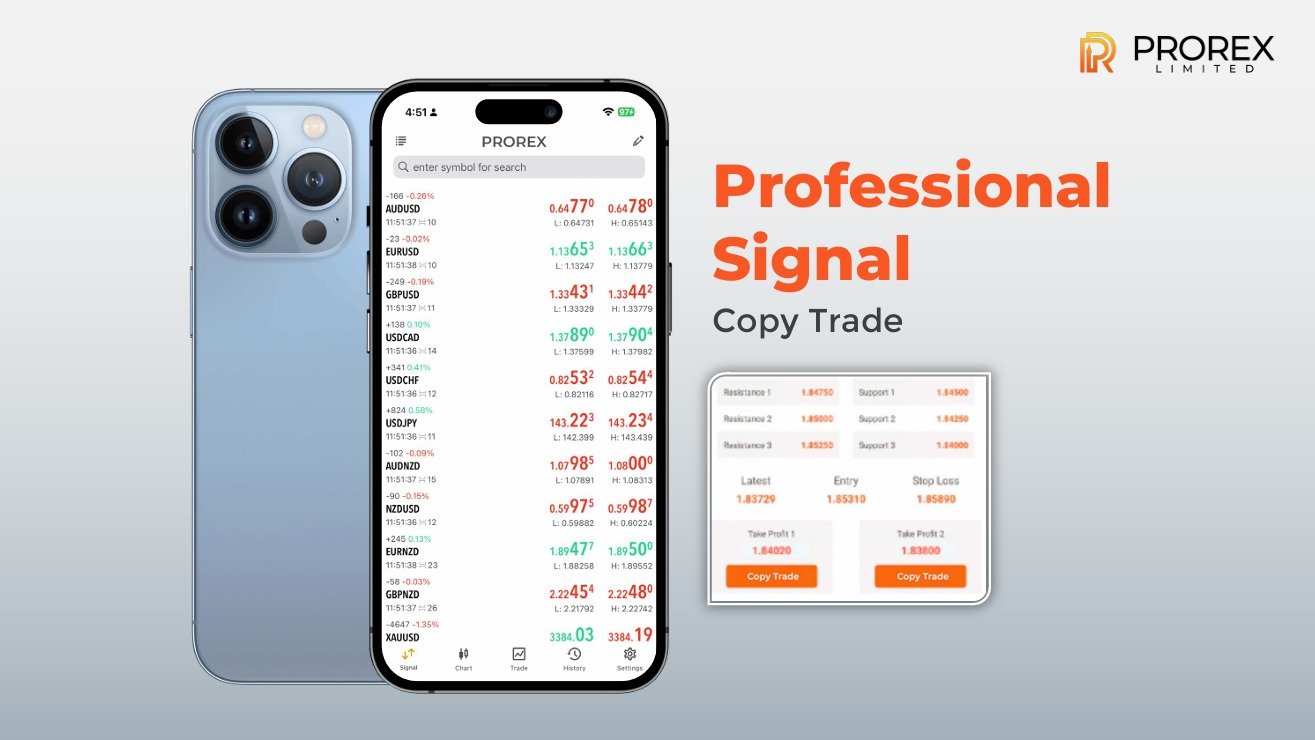

Your prorex trading platform is your command center. Your primary tactic is to achieve mastery over this interface for rapid, decisive action. In prorex online trading, speed and accuracy are paramount. The platform must serve your strategy, not hinder it. A key piece of actionable intelligence comes from the prorex trading signals. The strategic error is to follow these prorex signals blindly. The correct tactic is to use them as a confirmation signal—a way to corroborate your own analysis and increase the probability of a successful trade. Furthermore, managing the prorex spread is a critical cost-control tactic. For any high-volume strategy, minimizing transaction costs is fundamental to protecting your profit margins.

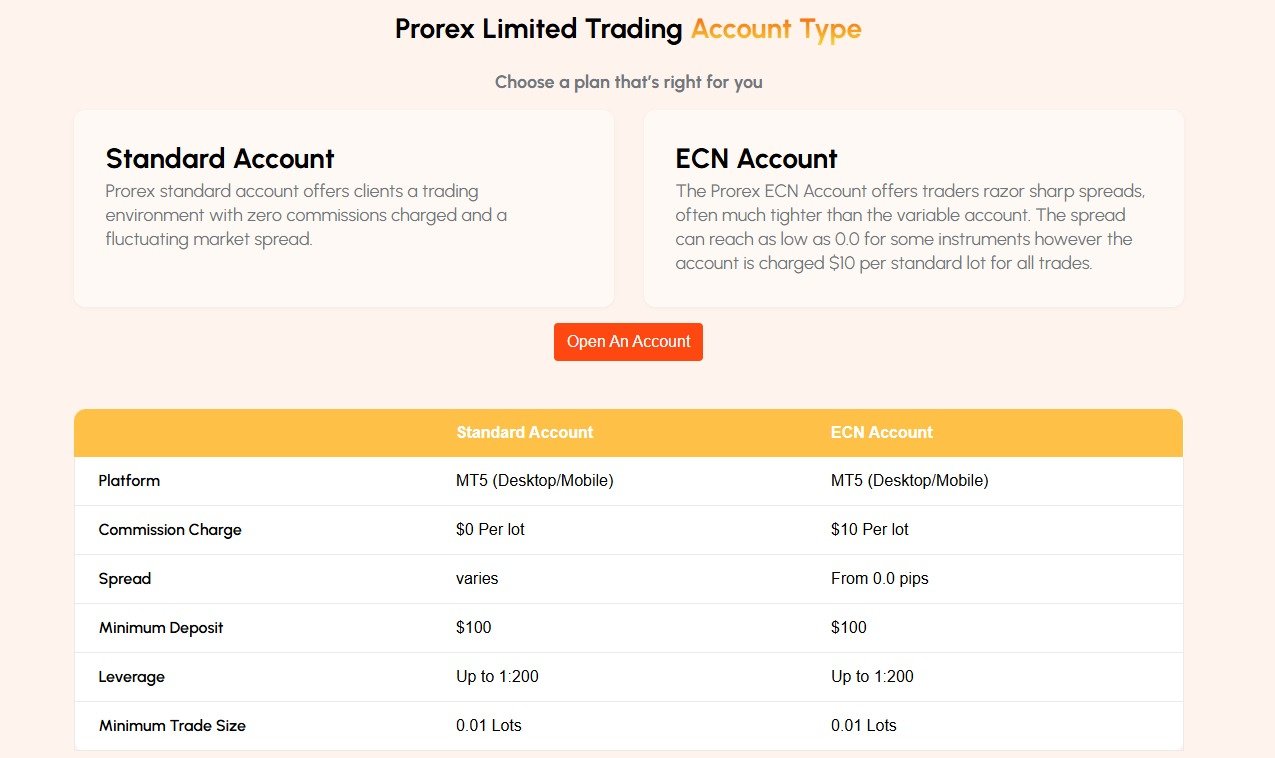

Strategic Capital Deployment via Your Prorex Investment Account

Your prorex account is your capital deployment vehicle. The strategy behind choosing from the different Prorex account types should be based on your operational phase. Traders can test a new strategy through an account with a low Prorex minimum deposit to reduce initial risk. Once the strategy proves effective, they can move up to a higher account tier that provides better trading conditions. Think of the Prorex deposit and withdrawal process as your capital logistics. For a trader, operational readiness means having the ability to move capital efficiently. Your logistics must be reliable to fund opportunities or secure profits without delay. Understanding how does Prorex investment work in this context is key to maintaining operational agility.

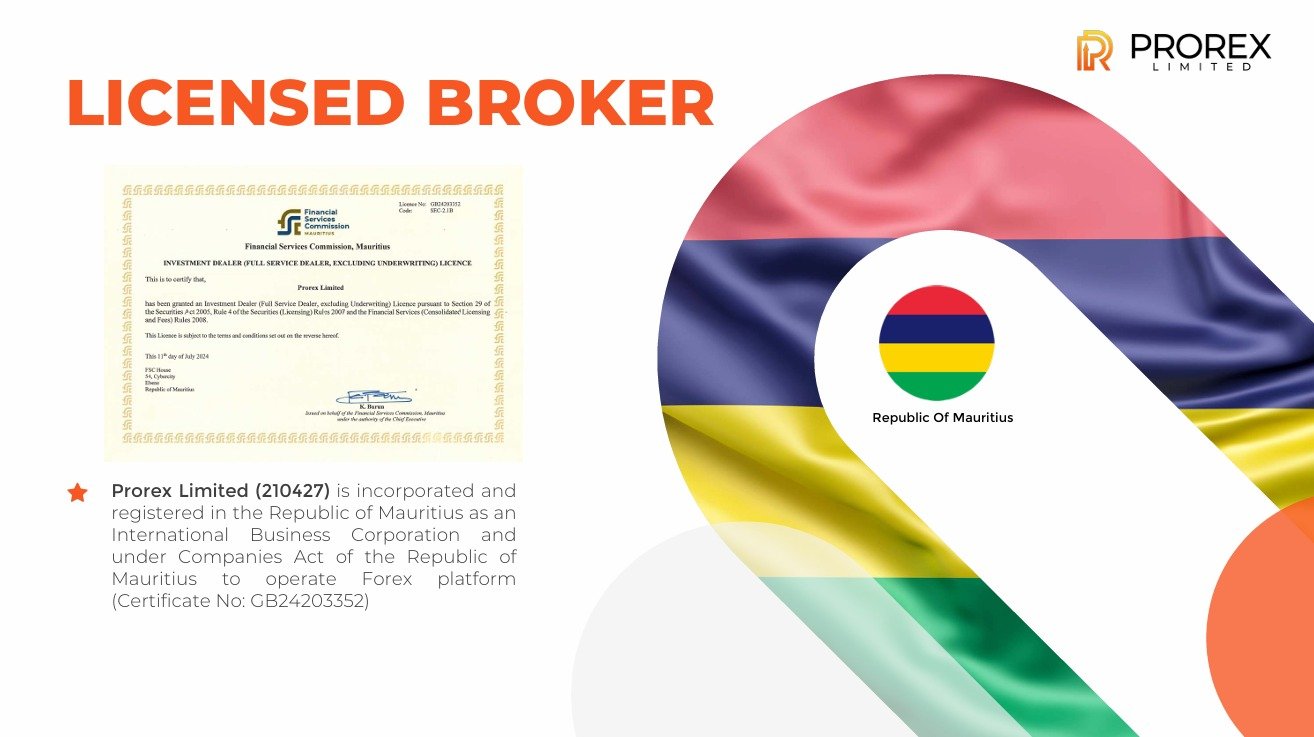

Fortifying Your Position: Risk Management and Due Diligence

The foundational pillar of any successful trading strategy is risk management. Your broker’s regulatory status is your primary security protocol. Begin your due diligence by confirming, “Is Prorex regulated?” The Prorex regulation framework protects traders and enforces compliance across every operation. A smart tactic is to conduct your own Prorex license verification on the regulator’s public database. This is a non-negotiable, pre-deployment check to fortify your position. You may also be offered a Prorex trading bonus. View this as tactical leverage. It can be a useful tool to amplify your capital if the terms align with your strategy, but it can become a liability if the conditions restrict your operational freedom.

Final Debrief: Aligning the Platform with Your Core Strategy

Your final decision must be a strategic one. The best forex trading platforms 2025 are those that seamlessly integrate with a trader’s methodology. Before opening a pprorex trading account for prorex forex trading, you must confirm that its entire operational framework—from its execution platform and the prorex trading signals accuracy to its capital logistics and security protocols—is in perfect alignment with your game plan. A successful trader chooses their tools deliberately. Make sure your broker aligns with your trading goals, because the right one drives every successful execution.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia